reit tax benefits ireland

A real estate investment trust REIT is a property investment company which very broadly simulates from a tax perspective direct investment in UK property and so avoids the. Web The tax regime for the operation of Real Estate Investment Trusts REIT in Ireland was introduced in Finance Act 2013 which inserted Part 25A.

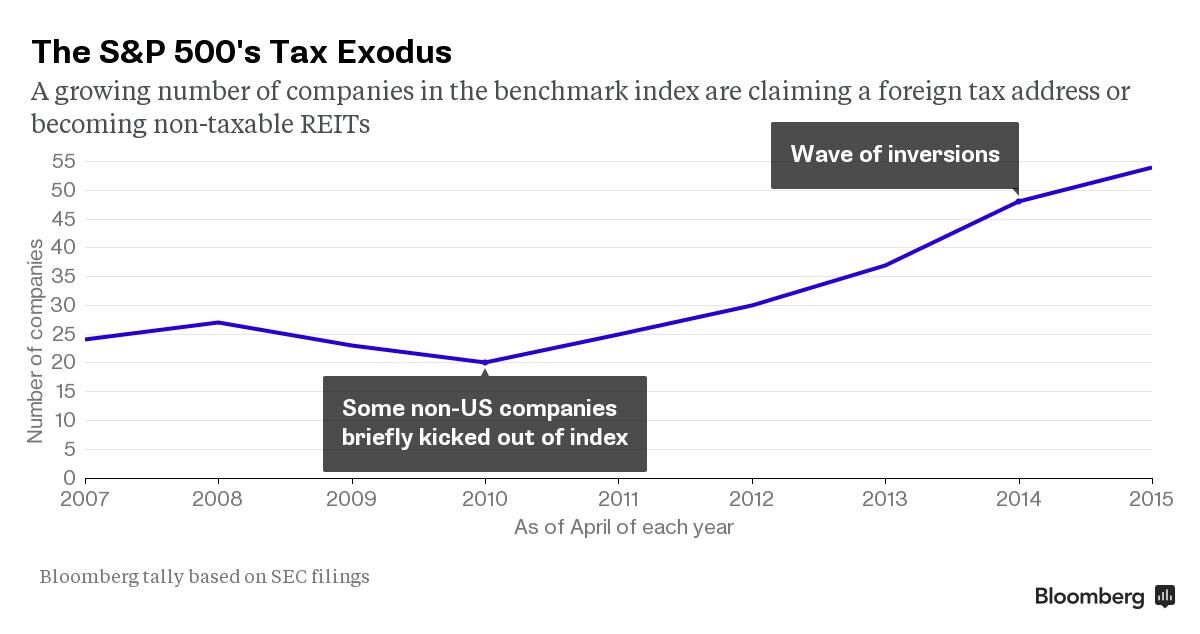

The Continuing Rise Of The Reit

Low take-up to date.

. It means that REITs invest at least three-quarters of their assets in real estate and must. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while. An Irish resident individual owning shares in an Irish REIT will be subject to Income Tax and USC on the dividends from the REIT.

7 The Tax Treatment of REITs 3 REIT distributions are taxed at. How are REITs taxed in Ireland. Most of the distribution from a REIT is taxed as ordinary.

Real Estate Investment Trusts REITs REITs are companies who earn rental income from commercial or residential property. Want growth income and great tax benefits. Qualification as a REIT In order to qualify for the REIT tax regime a REIT must.

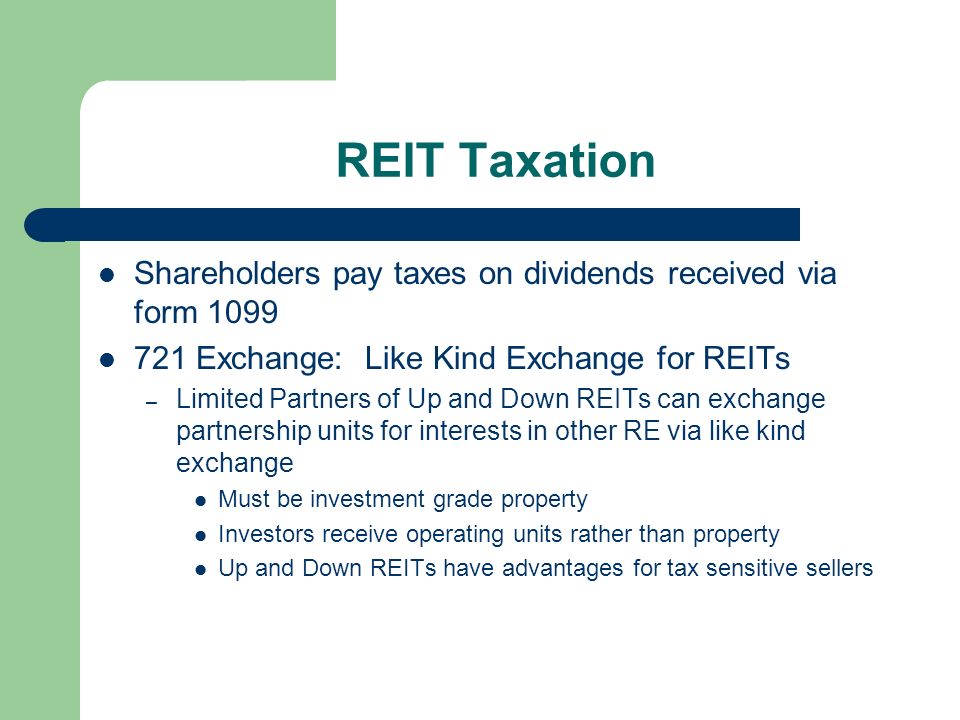

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. The transfer of shares in the REIT will be subject to 1 stamp duty. Limited partnerships and limited liability companies are generally the preferred vehicles for private investment in real estate due to their flexibility low cost and tax efficiency.

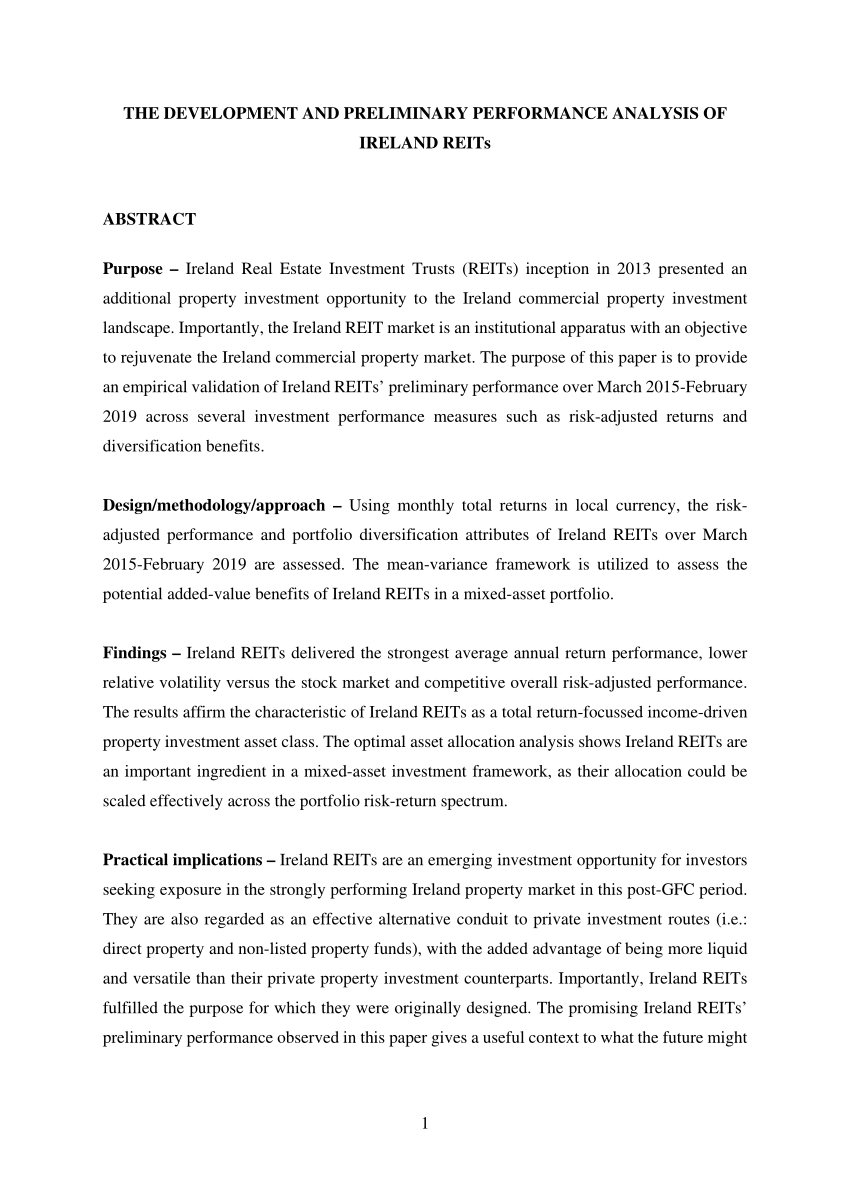

If the REIT held the property for more than one year long-term capital gains rates apply. The tax regime for the operation of Real Estate Investment Trusts REIT in Ireland was introduced in Finance Act 2013 which inserted Part 25A into the Taxes Consolidation Act. An Irish resident individual owning shares in an Irish REIT will be subject to Income Tax and USC on the dividends from the REIT.

REITs offer investors the benefits of real estate investment along with the ease and advantages of investing in publicly traded stock. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. Heres why REITs deserve a spot in your portfolio.

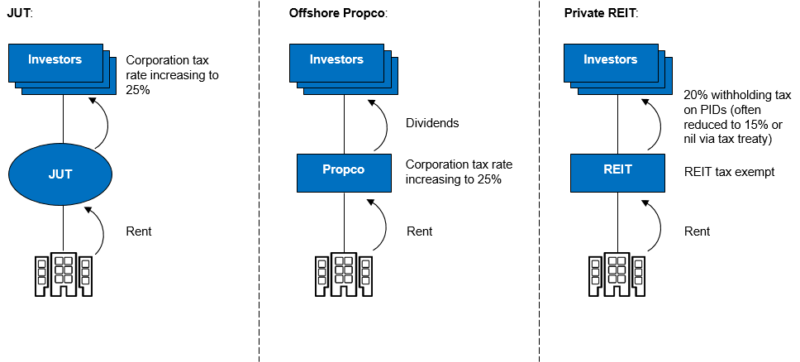

They are generally exempt from Corporation. Wachovia Hybrid and Preferred Securities WHPPSM Indicies. The use of real estate investment trusts REIT in real estate private equity fund structures has long been advised as a prudent strategy.

Where shares in a REIT are held by an investment. REITs benefit from a huge tax advantage that goes hand in hand with the 90 payout rule. Again this could reach a combined rate.

For one REITs pay no corporate income tax if they pay at least 90 of their taxable income to shareholders as dividends. 1 Be resident in Ireland and not resident. Web Investing in REITs.

REITs have historically provided. Specifically tax-exempt and foreign. In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions.

Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. Which Ireland has a double taxation agreement DTA or treaty may be able to reclaim some of the DWT if the relevant tax treaty permits.

Can You Do A 1031 Exchange Into Reit All Section 721 Rules

What Do Some Of My Favorite S P 500 Stocks Have In Common They Re All Reits Nasdaq

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Tax Transparent Property Funds

Educated Reit Investing The Ultimate Guide To Understanding And Investing In Real Estate Investment Trusts Wiley

Pdf The Development And Initial Performance Analysis Of Reits In Ireland

How Our Tax System Rewards Foreign Investors In Irish Property

Real Estate Investment Trusts Ireland

Session Plan Chapter Twelve Reits As Investment Alternative Ppt Download

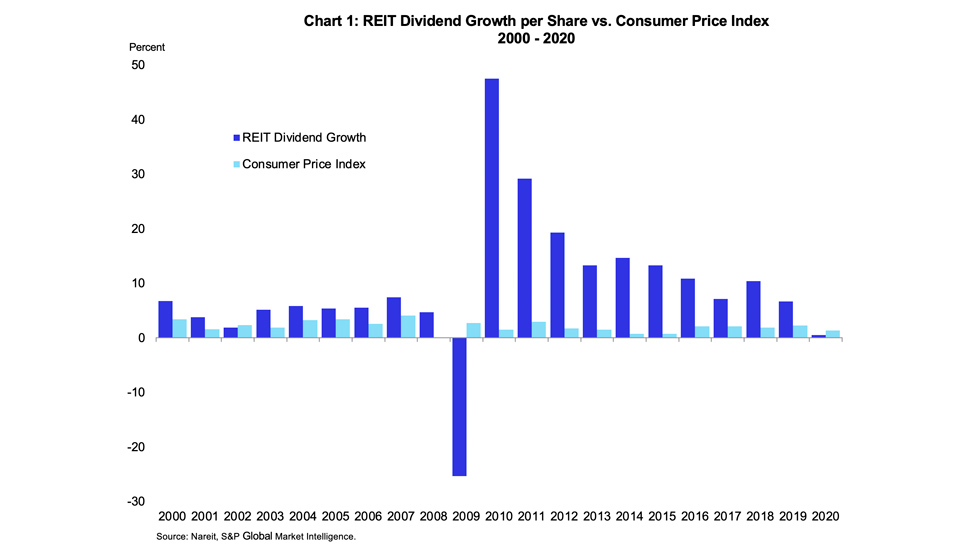

How Reits Provide Protection Against Inflation Nareit

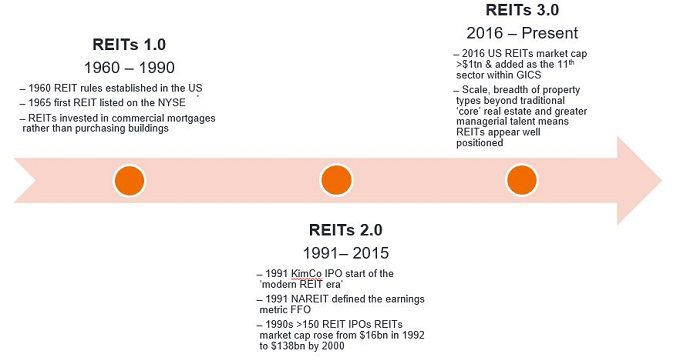

Investing In The Future With Reits 3 0 Janus Henderson Investors

3 Tax Smart Alternatives Cohen Steers

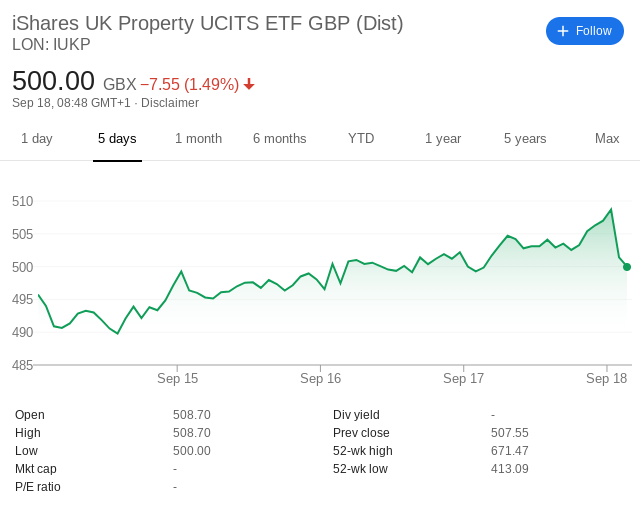

5 Popular Uk Reits Among Investors In October 2022

5 Popular Uk Reits Among Investors In October 2022

How Reit Regimes Are Doing In 2018 Ey Global

Income Stocks With A Trump Tax Bonus

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors